Corporations Are Weaponizing Free Speech To Wreck The World

Companies are exploiting the First Amendment to undermine rules that protect consumers and deter corruption.

by KATHERINE LI

Corporations are weaponizing the First Amendment to argue they don’t have to comply with regulations they oppose. Referencing faulty science and controversies they helped engineer, these companies have pioneered a novel legal strategy taking aim at emissions disclosures, drug price caps, social media reforms, and other consumer and public health protections.

Companies are backing their claims with the compelled-speech principle in the First Amendment, which states that the government cannot force people to say something they disagree with.

Experts say the large corporations using this strategy are undermining efforts to regulate corporate behavior. They say these arguments limit states’ ability to act on matters not covered by federal law — and threaten everything from consumer warnings on toxic products to nutrition labels for restaurant food.

Most pressingly, this approach is being used to challenge California’s new precedent-setting emissions disclosure law, which requires all major companies doing business in the state to make public how much pollution they’re emitting throughout their supply chain. Polluters argue that such laws unfairly compel them to engage in “controversial speech” — relying on the idea that climate change is still controversial, a concept many of these companies helped engineer.

Right-wing groups have weaponized this “compelled speech” argument before, using it to defend organizations that refuse to give their employees adequate reproductive health care benefits and support unlicensed pregnancy centers that intentionally mislead their clients. The argument has impeded the government’s ability to investigate financial wrongdoing. Foreign kleptocrats and domestic companies have allegedly exploited this lack of transparency to launder money through real estate investments and shell companies.

Major corporations have also picked up the argument in cases relating to drug pricing, social media, human rights, and emissions. In other cases, corporations have attempted to conceal the source of online political advertisements and deter states from addressing climate change.

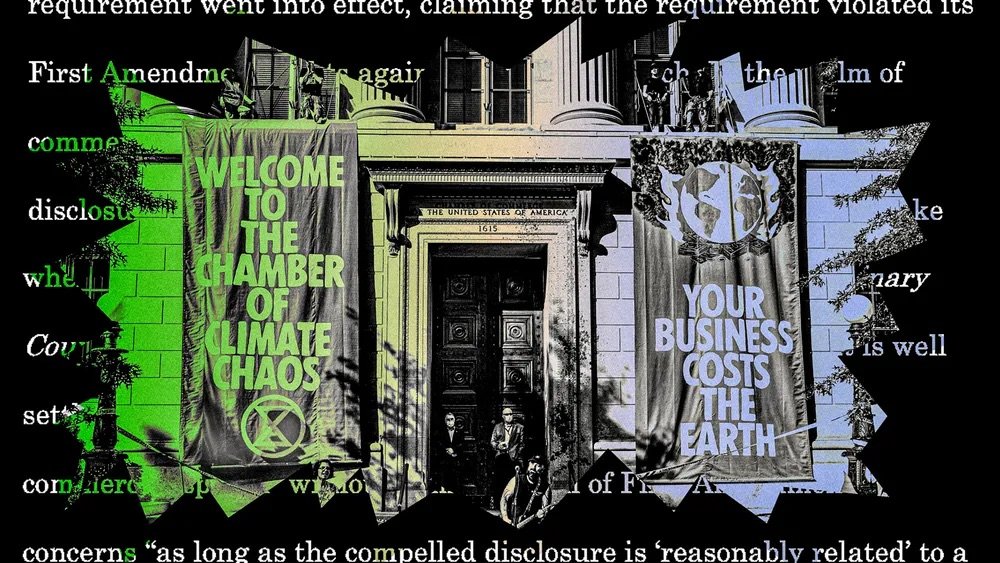

These efforts are being spearheaded by trade groups with financial backing from massive multinational corporations that have an interest in whittling away regulations. The U.S. Chamber of Commerce, a corporate lobbying group heavily funded by Big Oil, is involved in numerous compelled-speech cases that have emerged over the past decade.

If the courts agree that lawmakers can’t compel businesses to express “controversial” or “politically charged” messages, the effects could be devastating to wide-ranging regulatory efforts, said James Wheaton, founder of the public-interest law firm the First Amendment Project and former president of the Environmental Law Foundation.

“Anything can be political and controversial because science doesn’t deal in absolute certainty,” said Wheaton, “The threshold for proving controversy is extremely low, and the science behind it doesn’t have to be sound — it just needs to exist.”

Wheaton also expressed concern that trade groups and agriculture businesses fighting California’s emissions disclosure bill called the regulation a “pressure campaign” aimed at shaping company behavior. In their legal complaint, the corporate interests claimed that such disclosures would enable policymakers and activists to “single out companies” for boycotts and investigations.

“What is the point of any regulation then, if not to change and shape behavior?” said Wheaton.

Scarlet Letters And Confessions Of Sins

The “compelled speech” doctrine, detailed under the Constitution’s First Amendment, is designed to safeguard individuals from being forced by the government to express messages or adopt beliefs they disagree with — especially if the subject is considered controversial. For instance, the Supreme Court ruled in a landmark 1943 case that public school students could not be compelled to salute the American flag or recite the Pledge of Allegiance.

But over the past decade, businesses and right-wing interest groups have used the doctrine to fight — and successfully overturn — a series of regulations that protected investors, deterred criminal activity, and defended human rights.

In 2014, the U.S. Chamber of Commerce challenged the Securities and Exchange Commission over the agency’s “conflict mineral” rule, which aimed to inform consumers when companies relied on mineral extraction that exacerbated violence and humanitarian conflict.

The rule, which was designed to give consumers freedom of choice when they buy mineral-heavy products like computers and cars, was vehemently opposed by electronics and automobile manufacturers who argued that it would create a “scarlet letter statute” to shame businesses. An appeals court agreed, striking down part of the regulation that required company transparency.

Since then, similar lawsuits have ramped up. In 2020, Sysco, a food distribution and restaurant supplies company, took on the National Labor Relations Board, arguing that companies cannot be compelled to read out notices of labor violations to workers during work hours. According to Sysco’s lawsuit, the labor rule would contradict the company manager’s own message of advocating against unionization and mandate a “confession of sins.” The “sins” in this case involved repeated coercive threats to dismiss employees if they unionize.

These tactics have also been used to fight federal efforts to make medications more affordable. The Biden administration established a program in 2023 under the Inflation Reduction Act that aims to negotiate the maximum price of certain expensive drugs covered by Medicare and levy higher taxes on companies that refuse to negotiate. Blurring the lines of what qualifies as speech, the U.S. Chamber of Commerce argued in July 2023 that forcing pharmaceutical companies to “agree” with price determinations is government-compelled speech, an argument that the federal court of the Southern District of Ohio blocked in September 2023.

That same year, the U.S. Chamber of Commerce used the strategy to target a government rule mandating that companies disclose their stock buybacks to the Securities and Exchange Commission and investors. Stock buybacks, a practice that was considered illegal market manipulation until 1982, involve companies buying up their own stock to benefit shareholders at the expense of innovation and employee development.

The Chamber argued that requiring companies to disclose their rationale for repurchasing stock shares should qualify as compelled speech, even though legal scholars have said that “speech” like contracts or tax returns has traditionally been outside the scope of protected communication.

Better Markets, an advocacy group pushing for greater financial transparency and financial reform on Wall Street, filed an amicus brief backing the Securities and Exchange Commission rule, calling corporate such disclosures the “lifeblood” of security laws and the Chamber’s arguments a threat to “the foundation of securities regulation in the United States.”

The U.S. Court of Appeals for the Fifth Circuit ruled against the Securities and Exchange Commission and canceled its stock buyback rule in December 2023. This decision has made other mandatory shareholder disclosures, such as requiring companies to divulge their environmental or stock market risks, more vulnerable to legal challenges.

Small business associations used the same argument to challenge the government’s ability to fight money laundering and terrorism financing. Under the new Corporate Transparency Act, businesses must disclose the names and other personal information of people who own and control the company, in order to help uncover shell companies that are being used to hide unlawful activities.