What 250K NYC retirees can expect from Medicare Advantage as opt-out deadline approaches

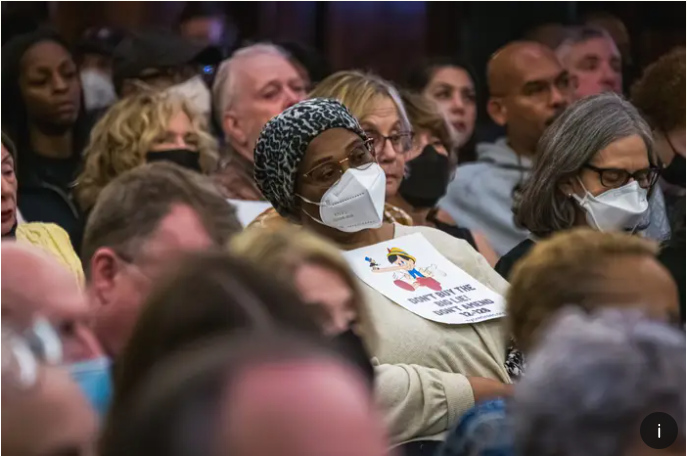

Erik McGregor/LightRocket via Getty Images

A Manhattan judge has temporarily blocked the city’s move to switch municipal retirees onto a new Medicare Advantage plan

A group of seniors requested the temporary restraining order when they filed a lawsuit in late May seeking to prevent the Adams administration from moving forward with the change in health coverage. The restraining order will be in place while that case proceeds in court.

Tens of thousands of retired New York City workers and their dependents have until Monday to decide whether to opt out of a new privatized Medicare plan that’s slated to replace their existing coverage in the fall, after the deadline was extended last month.

Otherwise, they will be enrolled in the new Aetna-run health plan automatically — a fate that some retirees are dreading despite reassurances about the quality of the plan from the insurance provider and city officials.

New York City seniors are grappling with this potential shift in their health coverage – which has been delayed for years amid protests and lawsuits – at a time when these private Medicare Advantage plans are exploding in popularity nationwide. Until now, most municipal retirees have been covered by traditional Medicare with a supplemental plan called SeniorCare paid for by the city. The only way for retirees to stay on traditional Medicare would be to forgo city health benefits entirely and pay for any supplemental coverage themselves.

Gothamist spoke with New York City doctors, as well as seniors and their family members, about how their own experiences with Medicare Advantage plans stack up to the hype – and the critiques.

What doctors have to say

There’s now a wide variety of Medicare Advantage plans on the market. They frequently offer a broader array of benefits than traditional Medicare, but some also have narrower networks of health care providers and have a reputation for making people jump through hoops to get the medical care their doctors recommend, said Tricia Neuman, executive director of the Program on Medicare Policy at KFF, a health care research nonprofit. Aetna has stated its plan for NYC municipal retirees is designed to minimize those issues.

But three New York City doctors who spoke to Gothamist said, given their experiences with other Medicare Advantage plans, they understand why people are concerned.

Dr. Thomas Sterry, a plastic surgeon affiliated with Mount Sinai, said he often helps with “touching things up” after a patient at the hospital gets a major surgery done, and those procedures can require inpatient rehab after the fact. Sterry said he can readily send patients to a rehab facility if they’re on regular Medicare, but that “the Advantage plans never approve it.”

He added that these denials even happen after multiple clinicians recommend the inpatient rehab.

“They force us to send the patient home, and they expect the patient to get some in-home physical therapy twice a week or something like that,” Sterry said. “It's just not even close to the same thing.”

Dr. Alex Shteynshlyuger, a Manhattan urologist, said he doesn’t actively participate in any Medicare Advantage plans because he finds them too time-consuming. But he said patients enrolled in those plans are sometimes able to see him even if he’s technically outside of their network – something Aetna stated will also be possible for seniors in the city-sponsored plan.

When Shteynshlyuger does see patients on Medicare Advantage plans, he said there is often a lot of extra paperwork involved, even for routine procedures. Often, he said, procedures that require prior authorization are eventually approved, but they could be delayed by weeks or months as patients await the green light from their insurer.

Dr. Loren Wissner Greene, an endocrinologist in Manhattan, echoed these concerns.

“We call it Medicare Disadvantage,” Greene said. “That's a common parlance in the medical community.”

Aetna and city officials have tried to alleviate any concerns and differentiate the plan for New York City retirees from other Medicare Advantage plans, which are also offered by other major insurers.

Medicare Advantage plans have expanded to cover about half of all Medicare-eligible seniors in the United States.

Part of how Medicare Advantage plans keep costs down, in general, is by requiring prior approval for a greater number of services than traditional Medicare, according to Neuman from KFF. Her organization reported earlier this year that Aetna’s Medicare Advantage plans had among the highest denial rates for medical services that were subject to prior authorization in 2021. But Aetna has agreed to cut back on the types of services that will be subject to that kind of scrutiny under its plan for New York City.

The insurance company states that it is also trying to maximize its network. When city officials testified on the Aetna plan at a City Council hearing earlier this year, they said about 85% of the doctors who accepted SeniorCare – the plan the city currently pays for as a supplement to traditional Medicare – would also accept the new coverage. They added that another 10% said they would see patients on Aetna’s Medicare Advantage plan even if they were not in-network.

But some retirees said they have talked to their doctors and were told they would not participate in the new plan. That’s what Lance Michaels, a 76-year-old former employee of the Department of City Planning, said he heard from his general practitioner, who treats him for Type 2 diabetes.

Michaels, who lives on Long Island, said he likes his existing coverage and doesn’t want it “monkeyed with.”

“I don't pay for anything, and the service has been good, and all the doctors I use accept it,” he said.

Why Medicare Advantage is so popular and what patients say about it

Despite being subject to growing scrutiny by the federal government, Medicare Advantage plans have expanded to cover about half of all Medicare-eligible seniors in the United States. These plans tend to advertise widely, and while federal officials have expressed concerns about misleading marketing, Neuman said the offerings appeal to many seniors due to extra benefits that are not covered under traditional Medicare. Advantage plans can also be cheaper than buying a supplemental plan to fill in the gaps, and some find it simpler to have all their health benefits on one plan, she added.

At the same time, Medicare Advantage plans have become a popular choice among the shrinking number of employers that still offer to help pay for their retirees’ health benefits — meaning NYC municipal retirees are not the only ones being ushered away from traditional Medicare and onto these plans by forces outside their control.

Neuman said most of the time when people are initially denied care under a Medicare Advantage plan, the decision is overturned on appeal. But she added that it still “creates a barrier to people receiving services that their doctor intended for them to receive.” The appeal process also takes time.